The company has two reportable segments finished pharmaceutical products and API products. Geographically the business presence of the firm is seen in the United States, China and France of which the U.S. accounts for the majority of the revenue. In addition, Amphastar Pharmaceuticals, Inc. has a VGM Score of D . Valuation metrics show that Amphastar Pharmaceuticals, Inc. may be overvalued. Its Value Score of D indicates it would be a bad pick for value investors.

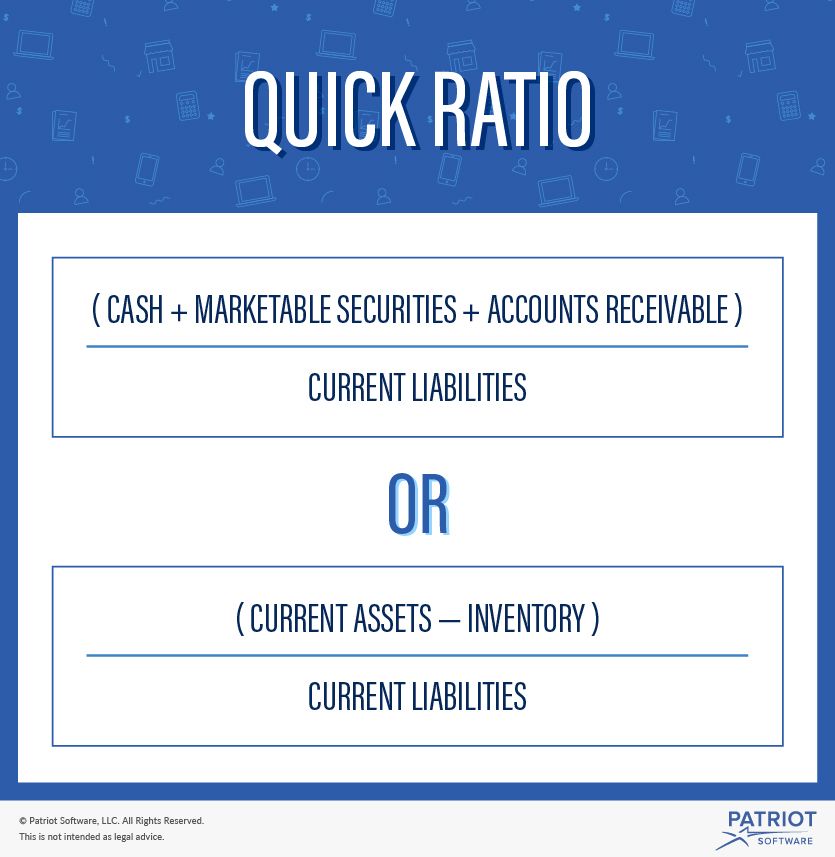

The Current Ratio is defined as current assets divided by current liabilities. It measures a company’s ability to pay short-term obligations. Current Cash Flow Growth measures the percent change in the year over year Cash Flow. Cash Flow is net income plus depreciation and other non-cash charges. A strong cash flow is important for covering interest payments, particularly for highly leveraged companies. Growth traders and investors will tend to look for growth rates of 20% or higher.

Amphastar Pharmaceuticals, Inc. (NASDAQ:AMPH) is favoured by institutional owners who hold 62% of the company

Since there is a fair amount of discretion in what’s included and not included in the ‘ITDA’ portion of this calculation, it is considered a non-GAAP metric. The EV/EBITDA ratio is a valuation multiple and is often used in addition, or as an alternative, to the P/E ratio. And like the P/E ratio, a lower number is typically considered ‘better’ than a higher number. Like the earnings yield, which shows the anticipated yield on a stock based on the earnings and the price paid, the cash yield does the same, but with cash being the numerator instead of earnings. For example, a cash/price ratio, or cash yield, of .08 suggests an 8% return or 8 cents for every $1 of investment. The Momentum Scorecard focuses on price and earnings momentum and indicates when the timing is right to enter a stock.

Exelixis Stock Shows Market Leadership, Earns 81 RS Rating – Investor’s Business Daily

Exelixis Stock Shows Market Leadership, Earns 81 RS Rating.

Posted: Tue, 21 Mar 2023 07:00:00 GMT [source]

Real-affluence within the united states last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. All investments involve risk, and not all risks are suitable for every investor.

About Amphastar Pharmaceuticals

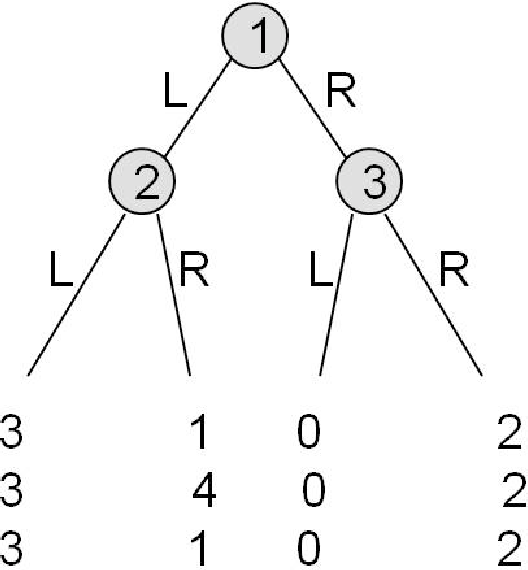

The most recent quarterly price change is given a weight of 40%, and each of the three previous quarters are given a weighting of 20%. During the month of March, Amphastar Pharmaceuticals Inc’s stock price has reached a high of $38.22 and a low of $33.61. But what if you had the insights to effectively evaluate a company like Amphastar Pharmaceuticals Inc before investing? Investing requires a certain perspective to avoid being overly confident in a company or worried about cyclical changes. A smart way to take the guesswork out of knowing when to buy or sell Amphastar Pharmaceuticals Inc’s stock is to have the right tools and resources as well as a clear monitoring process. And it’s about to change everything we know about everything.

- Live educational sessions using site features to explore today’s markets.

- Please visit /cryptocurrency to see a list of crypto available to trade.

- The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.

- For example, a cash/price ratio, or cash yield, of .08 suggests an 8% return or 8 cents for every $1 of investment.

- The past performance of a security, or financial product does not guarantee future results or returns.

Webull Financial LLC is a member of the Financial Industry Regulatory Authority , Securities Investor Protection Corporation , The New York Stock Exchange , NASDAQ and Cboe EDGX Exchange, Inc . Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. BECOME A MEMBER FOR ONLY $2 Get access to powerful investment discovery tools and a wealth of investment education to help you achieve your financial goals.

Amphastar Pharmaceuticals, Inc. engages in the development, manufacture, market, and sale of technically challenging and proprietary injectable, inhalation, and intranasal products. It operates through Finished Pharmaceutical Products, and Active Pharmaceutical Ingredients Products segments. The Finished Pharmaceutical Products segment manufactures, markets and distributes enoxaparin, cortrosyn, amphadase, naloxone, lidocaine jelly, as well as various other critical and non-critical care drugs. The Active Pharmaceutical Ingredients Products segment manufactures and distributes recombinant human insulin and porcine insulin.

Historical Prices for Amphastar Pharmaceuticals

Bank of Montreal Can now owns 13,029 shares of the company’s stock worth $477,000 after buying an additional 371 shares during the period. Maryland State Retirement & Pension System raised its holdings in shares of Amphastar Pharmaceuticals by 2.6% in the 3rd quarter. Maryland State Retirement & Pension System now owns 15,634 shares of the company’s stock valued at $439,000 after purchasing an additional 398 shares in the last quarter. Financial Gravity Asset Management Inc. bought a new stake in Amphastar Pharmaceuticals during the 3rd quarter valued at $2,110,000. Finally, Money Concepts Capital Corp lifted its position in shares of Amphastar Pharmaceuticals by 4.7% during the third quarter. Money Concepts Capital Corp now owns 10,099 shares of the company’s stock valued at $284,000 after buying an additional 454 shares during the last quarter.

Monitor the latest movements within the Aggregated Micro Power Holdings plc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the AMPH quote. 3 Wall Street research analysts have issued “buy,” “hold,” and “sell” ratings for Amphastar Pharmaceuticals in the last year.

Real-time analyst ratings, insider transactions, earnings data, and more. Amphastar Pharmaceuticals reported an EPS of $0.73 in its last earnings report, beating expectations of $0.4. Following the earnings report the stock price went up 14.752%. Amphastar Pharmaceuticals released its earnings results on Feb 28, 2023. The company reported $0.73 earnings per share for the quarter, beating the consensus estimate of $0.4 by $0.33.

It’s another great way to determine whether a company is undervalued or overvalued with the denominator being cash flow. Many investors prefer EV to just Market Cap as a better way to determine the value of a company. EBITDA, as the acronym depicts, is earnings before interest, taxes, depreciation and amortization. That means these items are added back into the net income to produce this earnings number.

We have 9 different ratings for every stock to help you appreciate its future potential. We’d like to share more about how we work and what drives our day-to-day business. CompareAMPH’s historical performanceagainst its industry peers and the overall market. Diversified revenue base, improving top line, strategic expansion initiatives and joint ventures poise Acadia Healthcare well for growth.

- The Earnings Yield (also known as the E/P ratio) measures the anticipated yield an investment in a stock could give you based on the earnings and the price paid.

- The Finished Pharmaceutical Products segment manufactures, markets, and distributes Primatene Mist, enoxaparin, naloxone, phytonadione, lidocaine, and other critical and non-critical care drugs.

- The Active Pharmaceutical Ingredients Products segment manufactures and distributes recombinant human insulin and porcine insulin.

- CompareAMPH’s historical performanceagainst its industry peers and the overall market.

It stands for Earnings before Interest, Taxes, Depreciation, and Amortization. It attempts to reflect the cash profit generated by a company’s operations. Amphastar Pharmaceuticals’ stock is owned by many different retail and institutional investors. Top institutional shareholders include Everence Capital Management Inc. (0.01%). 35 employees have rated Amphastar Pharmaceuticals Chief Executive Officer Jack Y. Zhang on Glassdoor.com. Jack Y. Zhang has an approval rating of 35% among the company’s employees.

The company products include Enoxaparin Sodium Injection; Amphadase; Cortrosyn for Injection; and… A stock with a P/E ratio of 20, for example, is said to be trading at 20 times its annual earnings. In general, a lower number or multiple is usually considered better that a higher one. Value investors will typically look for stocks with P/E ratios under 20, while growth investors and momentum investors are often willing to pay much more. Aside from using absolute numbers, however, you can also find value by comparing the P/E ratio to its relevant industry and its peers.

Note; companies will typically sell for more than their book value in much the same way that a company will sell at a multiple of its earnings. While a P/B of less than 3 would mean it’s trading at a discount to the market, different industries have different median P/B values. So, as with other valuation metrics, it’s a good idea to compare it to its relevant industry.

This suggests a possible upside of 1.4% from the stock’s current price. View analysts price targets for AMPH or view top-rated stocks among Wall Street analysts. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year.

It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. The X Industry values displayed in this column are the median values for all of the stocks within their respective industry. When evaluating a stock, it can be useful to compare it to its industry as a point of reference. For example, a regional bank would be classified in the Finance Sector. Within the Finance Sector, it would fall into the M Industry of Banks & Thrifts. And within the M Industry, it might further be delineated into the X Industry group called Banks Northeast.

A valuation method that multiplies the https://1investing.in/ of a company’s stock by the total number of outstanding shares. Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. Amphastar Pharmaceuticals stock price has been showing a declining tendency so we believe that similar market segments were not very popular in the given period. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.