It is therefore important that these assumptions are given a level of attention that reflects their practical implications. This review of the academic literature shows that there are important differences in the formulas used to derive the de-levered beta. These differences reflect the assumptions around the long-term financing strategy of a firm, and the discount rate applied to tax shields. The de-/re-levering formulas and their key assumptions are as shown in Table 1 below. The Hamada equation is a fundamental analysis method of analyzing a firm’s cost of capital as it uses additional financial leverage and how that relates to the overall riskiness of the firm.

Enter the total unlevered beta, tax rate, debt, and equity into the calculator. In the idealized capital asset pricing model , beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest. This is discussed in the CAPM article and the Security Market Line article. However, on average, the best forecast of the realized market-beta is also the best forecast of the true market-beta. Beta or levered beta is a measure of a firm’s systematic risk in relation to the market.

We will first derive the betas of these individual assets or firms from market prices. The derived betas are levered betas as they would reflect the capital structure of the respective firms. They have to be unlevered so as to only reflect their business risk components.

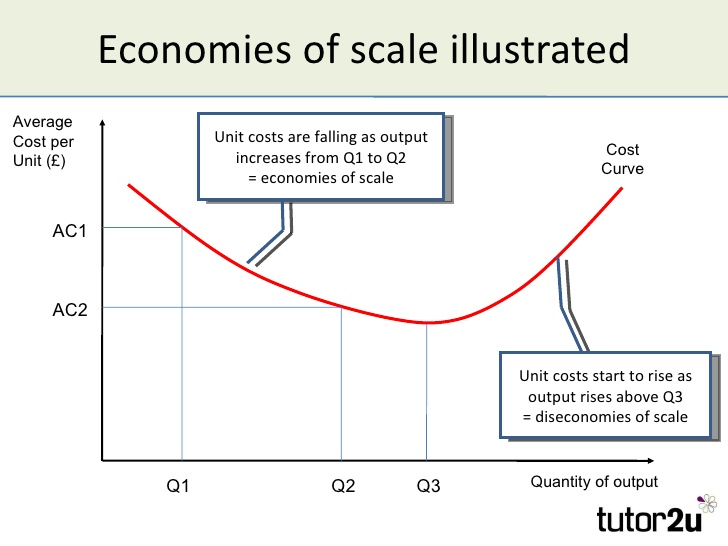

To understand why do we unlever and relever beta, we need to separately look at unlevered and relevered beta. While we have used the same risk premium, different Beta and Leverage ratios lead to a different value of WACC for the Computer Services industry and the Energy and Power segment. Of an asset based on the value of beta and expects a market return. Finally, you can use this Levered Beta in the cost of equity calculation. In this article, we explain the underlying assumptions of different beta de-/re-levering formulas and the economic principles behind each specification. Using it can determine the risk of a stock or the risk of your entire portfolio.

How to Calculate Percent Relative Range

The arbitrage pricing theory has multiple factors in its model and thus requires multiple betas. A benchmark can even be chosen to be similar to the assets chosen by the investor. For example, for a person who owns S&P 500 index funds and gold bars, the index would combine the S&P 500 and the price of gold. However, the resulting beta would no longer be a market-beta in the typical meaning of the term. A reasonable argument can be made that the U.S. stock market is too narrow, omitting all sorts of other domestic and international asset classes. Thus another occasional choice would be the use of international indexes, such as the MSCI EAFE. However, even these indexes have returns that are surprisingly similar to the stock market.

- Therefore, based on different levels of debt, the debt to equity ratio affects the level of beta, thereby increasing leverage.

- As a result, it is impossible to forecast future impacts on returns.

- XYZ has a standard deviation of returns of 22.12%, and NASDAQ has a standard deviation of returns of 22.21%.

- If the firm has zero debt, the asset beta and equity beta are the same.

Unlevered beta removes any beneficial or detrimental effects gained by adding debt to the firm’s capital structure. Comparing companies’ unlevered betas give an investor clarity on the composition of risk being assumed when purchasing the stock. Since companies have different capital structures and levels of debt, an investor can calculate the unlevered beta to effectively compare them against each other or against the market. Compared to levered beta, the asset beta does not take into effect the impact of financial leverage .

This leverage makes their earnings volatile, and investment in this company becomes risky. Levered beta considers the risk of leverage and its impact on the company’s performance. So, levered beta is not an ideal measure to compare two companies with different debt proportions. In such a scenario, you will have to remove the effect of debt by “unlevering” the beta. Unlevered beta will facilitate a better comparison for such companies than levered beta.

It means that an unlevered beta takes into account equity only, or we can say it removes the financial effects of leverage. Where $\beta_$ and $\beta_$ are the unlevered and levered betas of a firm respectively. $E$ is the market value of equity and $\tau$ is the tax rate. The Beta for BetaCorp will be the weighted average of unlevered betas where the weights are in proportion to the subsidiaries value in the firm, i.e. If capital structure comprised of 100% equity then beta would only reflect business risk. This beta would be unlevered as there is no debt in the capital structure.

Unsystematic risk specifically affects a stock, so it can be reduced by diversifying the portfolio. Now, Company A can use this re-levered beta, the risk-free rate, and the market risk premium to come up with the cost of equity. As said above, beta studies the impact of both equity and debt on the volatility of the stock. So, unlevered beta eliminates the impact of the debt component .

Levered Beta Calculator

The overall stock market is said to have a beta of 1.0, so companies with a beta of 1.0 should be expected to provide returns at an identical rate to the overall stock market, on average. Beta (β) represents a company’s sensitivity to market volatility – otherwise referred to as systematic risk – compared to the broader market, which is used as the standard benchmark. The weighted average cost of capital calculates a firm’s cost of capital, proportionately weighing each category of capital. Systematic risk is a risk that is completely out of the control of the company. This is extremely important when looking at investments that might be more prone to systematic risk.

Most Betas generally fall between the values range 1.0 to 2.0. The beta of a stock or fund is always compared to the market/benchmark. If a stock is benchmarked against the market and has a beta value greater than 1 (for example, we consider it as 1.6), this indicates that the stock is 60 percent riskier than the market as the market beta is 1. Asset beta is used to measure the risk of a security minus the company’s debt. The different approaches that can be used to de-lever and re-lever betas start from the same principle—that a firm’s value is equal to the present value of its cash flows.

4 The example in this article is illustrative and starts from the same de-levered beta. Typically, beta estimations start from a sample of levered betas, which is converted to de-levered betas and finally re-levered to the gearing ratio of the firm of interest. In a typical beta estimation process, where the same formula is applied to the de-levering and re-levering steps, the differences between formulas will be smaller than in our example. Note also that it is not always the case that the Harris–Pringle or practitioners beta will exceed the Hamada beta.

Debt beta might not capture the full picture of the risk profile, and hence this might lead to results being affected. Debt Beta is only reliable in the case where the debt has a contingency, on a certain event that might take place in the future. In other cases, it is often treated as a relatively safe and stable asset source. This is because of the fact that it is representative of the risk of leveraging that the business has undertaken over the course of time. We endeavor to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide. Treasury BillsTreasury Bills (T-Bills) are investment vehicles that allow investors to lend money to the government.

Why do we Relever Beta?

To measure performance without the impact of capital structure, we need unlevered Beta or Asset Betas. An investor is looking to calculate the beta of company XYZ compared to the NASDAQ. XYZ has a standard deviation of returns of 22.12%, and NASDAQ has a standard deviation of returns of 22.21%. Based on data over the past three years, the correlation between the firm XYZ and NASDAQ is 0.82.

Beta thus measures the contribution of an individual investment to the risk of the market portfolio that was not reduced by diversification. It does not measure the risk when an investment is held on a stand-alone basis. If you’re interested in Levered and unlevered beta, check out our CAPM article. After we unlever beta, we can relever it for any combination of capital structure we want. For instance, if we want to get the beta with 20% debt, then we first need to unlever the beta, then relever it for 20% debt. The below example will walk you through the 4 steps you need to complete to find the levered beta of a company (Ex. McDonald’s).

But it can be considered a positive sign if it is comparatively lower than other companies. A beta of one means a company has an equal risk to the total market. While a value above one signals the company carries more risk.

Company

Now, if investors want to look at the company’s potential as it had no debt, then they can use the unlevered beta. The unlevered beta treats the company as if it had zero debt. This is where you would convert the unlevered beta back to levered beta by using McDonald’s specific capital structure . This is done to account for the impact of company debt so that you can use this figure in the CAPM formula to solve for the cost of equity.

Now that we have all inputs for the formula, we can use it to find the equity beta. Gold stocks are some of the only securities with negative beta. This includes Barrick Gold ($GOLD), one of the largest gold mining companies. For example, a company with a beta of 1.2 is considered riskier than the market.

Beta is a statistical measure that compares the volatility of the price of a stock against the volatility of the broader market. If the volatility of the stock, as measured by beta, is higher, the stock is considered risky. If the volatility levered beta formula of the stock is lower, the stock is said to have less risk. Unlevered beta strips off the debt component to isolate the risk due solely to company assets. Debt and equity are factored in when assessing a company’s risk profile.